Business Funding

|

What is Merchant Cash Advance? A Merchant Cash Advance provides business owners with access to their needed capital. The company providing the funds advances the cash by purchasing a pre-determined amount of the business sales volume sold through a merchant account. |

|

|

|

What is Merchant Loan?

A small business loan refers to receiving a lump sum of working capital to use for business purposes. The best feature about this type of loan is that there is a fixed payment amount which is automatically deducted from your business bank account on either a daily, weekly, or monthly basis. |

|

What is Merchant Line of Credit? A line of credit is a flexible business financing option that allows quick access to a defined amount of working capital. The way it works is a business is approved for a set amount of credit and has access to that amount through a streamlined process which allows for quick and easy access to draw on the approved amount when needed. We can facilitate access to line of credit financing from $5,000 up to $250,000. |

|

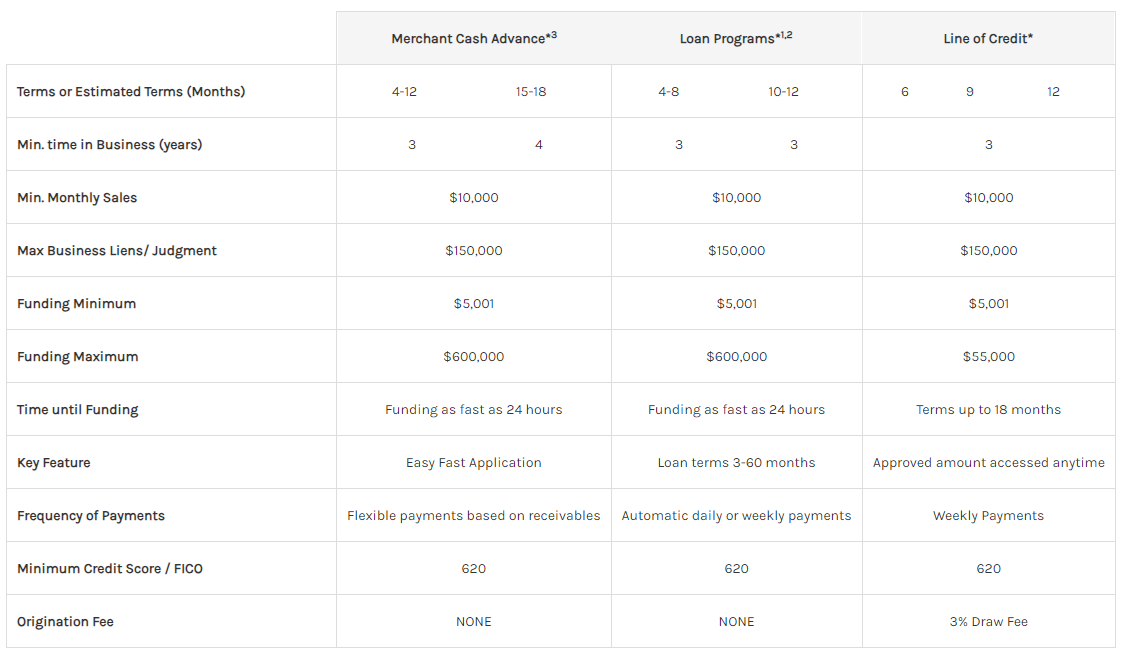

| Merchant Cash Advance*3 | Loan Programs*1,2 | Line of Credit* | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Terms or Estimated Terms (Months) |

|

|

|

|||||||

| Min. time in Business (years) |

|

|

3 | |||||||

| Min. Monthly Sales | $10,000 | $10,000 | $10,000 | |||||||

| Max Business Liens/ Judgment | $150,000 | $150,000 | $150,000 | |||||||

| Funding Minimum | $5,001 | $5,001 | $5,001 | |||||||

| Funding Maximum | $600,000 | $600,000 | $55,000 | |||||||

| Time until Funding | Funding as fast as 24 hours | Funding as fast as 24 hours | Terms up to 18 months | |||||||

| Key Feature | Easy Fast Application | Loan terms 3-60 months | Approved amount accessed anytime | |||||||

| Frequency of Payments | Flexible payments based on receivables | Automatic daily or weekly payments | Weekly Payments | |||||||

| Minimum Credit Score / FICO | 620 | 620 | 620 | |||||||

| Origination Fee | NONE | NONE | 3% Draw Fee |

What is Merchant Cash Advance?

A Merchant Cash Advance provides business owners with access to their needed capital. The company providing the funds advances the cash by purchasing a pre-determined amount of the business sales volume sold through a merchant account.

Many like the fact that you are only required to pay a fixed % of your credit card sales so if your sales slow down to a second COVID wave or other unforeseeable issues your safe. You have no accruing interest or fixed payback period.

Business owners can qualify for a Merchant Cash Advance between $5,000 and ranges up to $500,000 with our programs.

What is Merchant Loan?

A small business loan refers to receiving a lump sum of working capital to use for business purposes. The best feature about this type of loan is that there is a fixed payment amount which is automatically deducted from your business bank account on either a daily, weekly, or monthly basis.

Business owners can get access to working capital as small as $5,000 that ranges up to $1 million.

What is Merchant Line of Credit?

A line of credit is a flexible business financing option that allows quick access to a defined amount of working capital. The way it works is a business is approved for a set amount of credit and has access to that amount through a streamlined process which allows for quick and easy access to draw on the approved amount when needed. We can facilitate access to line of credit financing from $5,000 up to $250,000.

* = Must have a current Merchant Account with Commerce Technologies or sign up for such services to apply for Business Funding.

1 = Loans not available in New Jersey, Montana, Nevada, Rhode Island, Vermont, North Dakota, South Dakota.

2 = Other restrictions for specific entity types on loan products may apply.

3 = Under MCAs - Min. Monthly Sales Refers to minimum credit card processing volume.