Payroll

As an employer, you have specific payroll responsibilities that are required by government agencies. These agencies can be federal, state or local. Some of these responsibilities include, but are not limited to, withholding amounts from your employees' compensation to cover income tax, social security, Medicare, and other payments. Intuit’s Payroll Services assist you with these responsibilities.

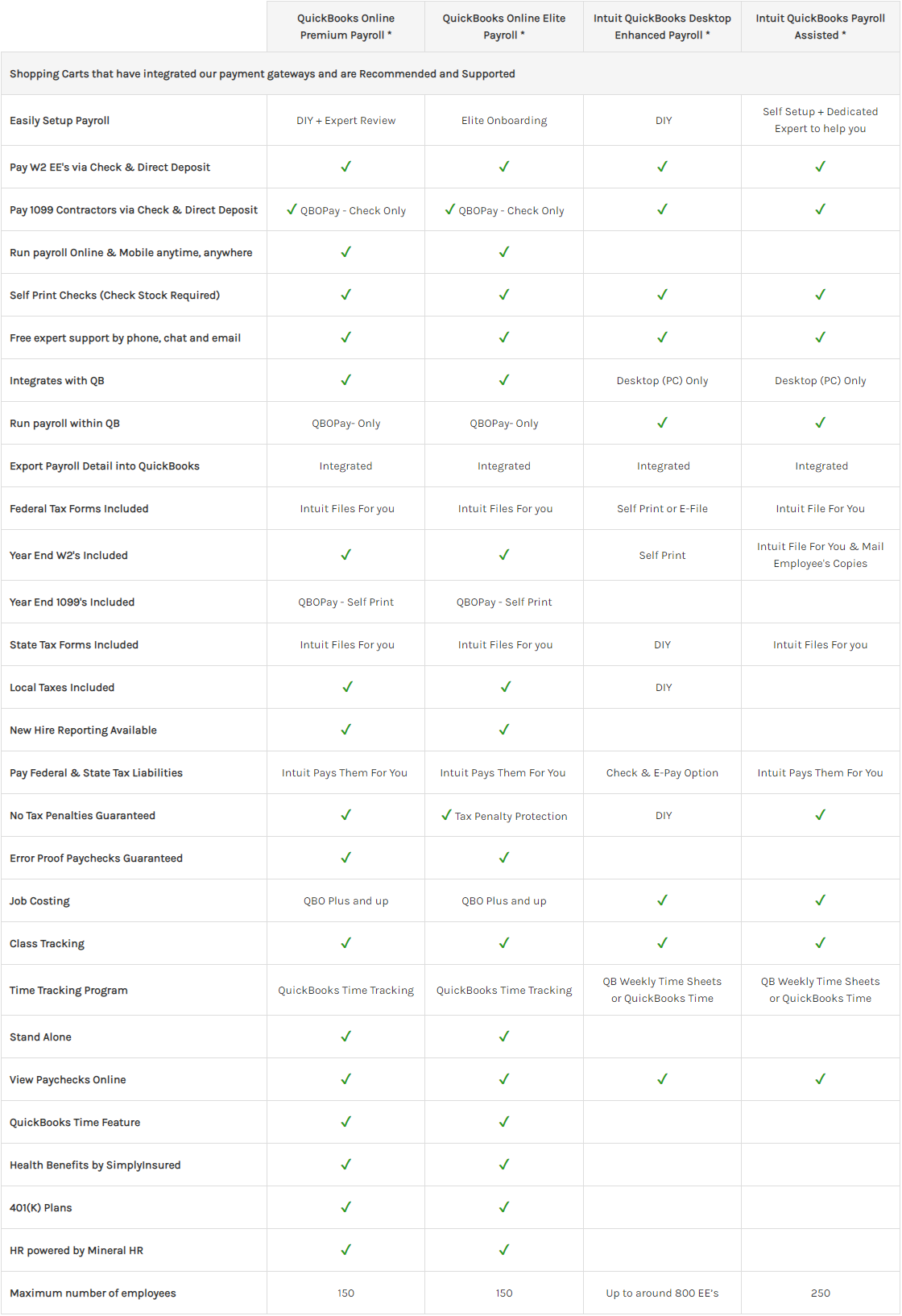

| QuickBooks Online Payroll Core * | QuickBooks Online Payroll Premium * | QuickBooks Online Payroll Elite * | QuickBooks Desktop Payroll Enhanced * | QuickBooks Desktop Payroll Assisted * | |

|---|---|---|---|---|---|

| Shopping Carts that have integrated our payment gateways and are Recommended and Supported | |||||

| Easily Setup Payroll | DIY | DIY + Expert Review | Elite Onboarding + Expert Review | DIY | Self Setup + Dedicated Expert to help you |

| Pay W2 EE's via Check & Direct Deposit | ✔ | ✔ | ✔ | ✔ | ✔ |

| Pay 1099 Contractors via Check & Direct Deposit | ✔ QBOPay | ✔ QBOPay | ✔ QBOPay | ✔ | ✔ |

| Run payroll Online & Mobile anytime, anywhere | ✔ | ✔ | ✔ | ||

| Self Print Checks (Check Stock Required) | ✔ | ✔ | ✔ | ✔ | ✔ |

| Free expert support by phone, chat and email | ✔ | ✔ | ✔ | ✔ | ✔ |

| Integrates with QB | ✔ | ✔ | ✔ | Desktop (PC) Only | Desktop (PC) Only |

| Run payroll within QB | QBOPay- Only | QBOPay- Only | QBOPay- Only | ✔ | ✔ |

| Export Payroll Detail into QuickBooks | Integrated | Integrated | Integrated | Integrated | Integrated |

| Federal Tax Forms Included | Intuit Files For you | Intuit Files For you | Intuit Files For you | Self Print or E-File | Intuit File For You |

| Year End W2's Included | ✔ | ✔ | ✔ | Self Print | Intuit File For You & Mail Employee's Copies |

| Year End 1099's Included | QBOPay - Self Print | QBOPay - Self Print | QBOPay - Self Print | ||

| State Tax Forms Included | Intuit Files For you | Intuit Files For you | Intuit Files For you | DIY | Intuit Files For you |

| Local Taxes Included | ✔ | ✔ | DIY | ||

| New Hire Reporting Available | ✔ | ✔ | ✔ | ||

| Pay Federal & State Tax Liabilities | Intuit Pays Them For You | Intuit Pays Them For You | Intuit Pays Them For You | Check & E-Pay Option | Intuit Pays Them For You |

| No Tax Penalties Guaranteed | ✔ | ✔ | ✔ Tax Penalty Protection | DIY | ✔ |

| Error Proof Paychecks Guaranteed | ✔ | ✔ | ✔ | ||

| Job Costing | QBO Plus and up | QBO Plus and up | QBO Plus and up | ✔ | ✔ |

| Class Tracking | ✔ | ✔ | ✔ | ✔ | ✔ |

| Time Tracking Program | QuickBooks Time Tracking** | QuickBooks Time Tracking | QuickBooks Time Tracking | QB Weekly Time Sheets or QuickBooks Time** | QB Weekly Time Sheets or QuickBooks Time** |

| Stand Alone | ✔ | ✔ | ✔ | ||

| View Paychecks Online | ✔ | ✔ | ✔ | ✔ | ✔ |

| QuickBooks Time Feature | ✔ | ✔ | ✔ | ✔ | ✔ |

| Health Benefits by SimplyInsured | ✔ | ✔ | ✔ | ||

| 401(K) Plans | ✔ | ✔ | ✔ | ||

| HR powered by Mineral HR | ✔ | ✔ | |||

| Maximum number of employees | 150 | 150 | 150 | Up to around 800 EE’s | 250 |

As an employer, you have specific payroll responsibilities that are required by government agencies. These agencies can be federal, state or local. Some of these responsibilities include, but are not limited to, withholding amounts from your employees' compensation to cover income tax, social security, Medicare, and other payments. Intuit’s Payroll Services assist you with these responsibilities.

* = Payroll Services are USA based only

**= Separate purchase of QuickBooks Time required