Check Services

Check Services are payment services that allow online and traditional merchants to accept and process checks from consumer and corporate bank accounts safely and securely regardless of whether the business is retail, mail/phone order or internet-based.

Having the ability to accept checks is a vital component of the revenue flow for any business considering the fact that 1/3 of non cash payments are made with paper checks. Listed below are facts and statistics on the check processing industry:

- 25% of the buying public does not have a major credit card and 83% of the total consumers who do not have a credit card write personal checks when shopping.

- Automated Clearing House (ACH) transactions hit a record of 23 billion transactions valued at more than $51.2 trillion in 2018.

- 96% of all checks are now electronically processed during the clearing process.

- 74% of all business-to-business payments are made by check.

|

Benefits of accepting checks:

|

| > | Consumers initiate check payment on merchants website or payment gateway (Bill Payments or eCommerce). |

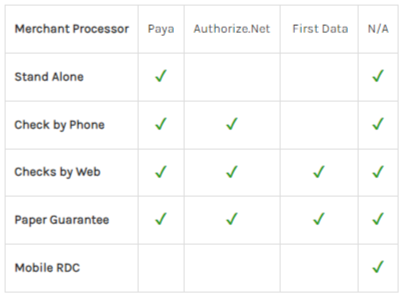

| Merchant Processor | Paya Services | eCheck.Net | Telecheck | CrossCheck |

| Stand Alone | ✔ | ✔ | ||

| Check by Phone | ✔ | ✔ | ✔ | |

| Checks by Web | ✔ | ✔ | ✔ | ✔ |

| Paper Guarantee | ✔ | ✔ | ✔ | ✔ |

| Mobile RDC | ✔ |

Check Services are payment services that allow online and traditional merchants to accept and process checks from consumer and corporate bank accounts safely and securely regardless of whether the business is retail, mail/phone order or internet-based.

Having the ability to accept checks is a vital component of the revenue flow for any business considering the fact that 1/3 of non cash payments are made with paper checks. Listed below are facts and statistics on the check processing industry:

- 25% of the buying public does not have a major credit card and 83% of the total consumers who do not have a credit card write personal checks when shopping.

- Automated Clearing House (ACH) transactions hit a record of 23 billion transactions valued at more than $51.2 trillion in 2018.

- 96% of all checks are now electronically processed during the clearing process.

- 74% of all business-to-business payments are made by check.

Benefits of accepting checks:

- Increase sales by expanding payment options to your existing and new customers.

- Increase customer satisfaction.

- Easy access to funds in 2-3 business days since checks are automatically deposited into your checking account electronically.

- No trips to bank - so no gas/labor expenses.

- No check returned due to NSF if using guarantee.

- Completely eliminate bank NSF fees if using guarantee.

- Check services rates are usually lower than credit card rates.

- Easy reconciliation with access to online reports and statements.

For face-to-face transactions, Point of Sale Conversion enables merchants to process checks electronically... just like a credit card.

Accept any type of check, in a point of sale or consumer-not-present environment. Electronic deposit lets you skip the trip to the bank.

Enabling merchants to accept and process checks from their customers over the phone.

Guaranteed funding on paper checks accepted face-to-face that are then manually deposited in the bank.

Process single or recurring ACH debit transactions from the checking account of a consumer or another business.

Mobile Merchants can debit consumers checking account utilizing any touch tone phone. Guaranteed Funding is available.

Consumers initiate check payment on merchants website or payment gateway (Bill Payments or eCommerce).